Please note, this material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Whether you’re a trained and savvy solar professional or only started looking into solar yesterday, this article will provide you with everything you need to know as we approach the first year of the tax incentive decline. The remainder of 2019 will be the last chance for those involved in the solar industry to exploit the full 30% credit before it steps down from 30% to 26%. In order to best advise today’s customers and clients, contractors and distributors alike will need to familiarize themselves with the rules and regulations surrounding the “Commence Construction” Clause.

Beginning with the Energy Policy Act in 2005, solar professionals throughout the US have been attentively keeping an eye out for any and all information regarding the first major government regulated incentive towards renewable energy technologies- the Investment Tax Credit (ITC). This enactment of the ITC was the first time that solar energy project owners were offered access to a 30% tax credit on a cost basis of their qualified energy property in the year that it was first put into service.

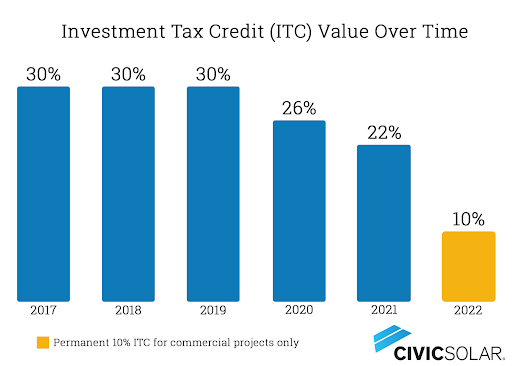

In 2015, on the eve of the expiration of the original 30% ITC, Congress approved the Consolidated Appropriations Act of 2015 (P.L. 114-113). This included an extension of the 30% ITC for both commercial and residential projects through Dec 31, 2019, with a step down to 26% in 2020, and 22% in 2021. In 2022 the remaining 10% tax credit would remain intact for commercial projects only. In addition to extending the ITC tax credit, this Act also amended the requirement for qualifying a project from having to be “in-service” to instead needing to have “commenced construction”. According to the IRS Notice 2018-59, the two steps necessary to indicate that you’re eligible for this year’s tax credit under the “commence construction” clause are as follows:

-

PHYSICAL WORK TEST: SECTION 4.02-.04: “The Physical Work Test requires that a taxpayer begin physical work of a significant nature. This test focuses on the nature of the work performed, not the amount or the cost.” This work performed can include the installation of racks or other various structures to attach PV panels, collectors, or solar cells to the site (4.02.2.A). This does not include any preliminary activities such as planning or designing an array design, obtaining permits or licenses, securing financing, the clearing of a site, or conducting geophysical/environmental/engineering surveys of the site (4.03). It is important to note that physical work also does not include the effort involved in producing “the components of the energy property that are either in existing inventory or are normally held in inventory by a vendor.”

-

Continuous Construction Test (Section 6): “Involves continuing physical work of a significant nature. Whether a taxpayer maintains a continuous program of construction to satisfy the Continuity Requirement will be determined by the relevant facts and circumstances.”

-

-

FIVE PERCENT SAFE HARBOR: SECTION 5. 01-.02: “Construction of energy property will be considered as having begun if: (1) a taxpayer pays or incurs 5% percent or more of the total cost of the energy property, and (2) the taxpayer makes continuous efforts to advance towards completion of the energy property” (5.01). Meaning that the estimated total of all costs of the energy venture in question are taken into account when trying to evaluate whether or not the Five Percent Safe Harbor standard has been established. This total does not include the price of the land intended to house the energy property.

-

Continuous Efforts Test (Section 6): “Whether a taxpayer makes continuous efforts to advance towards completion of an energy property to satisfy the Continuity Requirement includes, but is not limited to: (a) paying additional amounts included in the total cost of the energy property; (b) entering into binding written contracts for the manufacture, construction, or production of components of property or for future work to construct the energy property; (c) obtaining necessary permits; and (d) performing physical work of a significant nature.”

-

“Do I have to complete both of these steps before January 1, 2020 in order to satisfy the requirements necessary to receive the 2019 tax credit?”

– In section 3.02 of the IRS Notice 2018-59, it is explained that while yes solar project taxpayers must implement both of these actions in order to qualify the “commence construction” clause, the construction will be considered to be underway starting on the date the taxpayer first establishes the first of these two methods. “For example, if a taxpayer performs physical work of a significant nature on [the] energy property in 2018, and then pays five percent or more of the total cost of the energy property in 2019, construction will be deemed to begin in 2018 under the Physical Work Test, not in 2019 under the Five Percent Safe Harbor” (Section 3.02).

“I heard I have 4 years to complete my energy project and still apply for the ITC credit level of the year in which I first “Commenced Construction”, is that true?”

-

According to an article released by McDermott the answer is technically yes, but let me explain. This notice clarifies that after a commercial project has been approved for the ITC (aka the taxpayers have been able to purchase equipment equal to 5% of anticipated project costs and passed the Physical Work Test) in 2019 it will permit projects placed in service up until January 1st, 2023 to qualify for the ITC at the current 30% rate from 2019. Although it is important to note that construction and significant payments of the energy property must continue throughout this 4 year time period to remain in good graces for the Continuity Safe Harbor.

-

“If a taxpayer places an energy property in service by the end of a calendar year that is no more than four calendar years after the calendar year during which construction of the energy property began (“the Continuity Safe Harbor Deadline”), the energy property will be considered to satisfy the Continuity Safe Harbor. For example, if construction begins on an energy property on January 15, 2018, and the energy property is placed in service by December 31, 2022, the energy property will be considered to satisfy the Continuity Safe Harbor (Section 6.05).”

Based on the information gathered from the IRS Report 2018-59 to claim the 30% ITC this year all you have to do is: Make a 5% payment on the total cost of the system in conjunction with a written contract to guarantee the continuous development of the solar array, or begin physical work of a significant nature in regards to the installation process (ie. “racking or other structures to affix PV panels, collectors, or solar cells to a site”) before January 1st, 2020.

Claim your tax credit now!

Find all the information you need from Solar Power Rocks

Sources:

https://www.greentechmedia.com/

https://www.greentechmedia.com/

Image: