RSVP here!

RSVP here!

Category: Uncategorized

Stop CenHud Rate Increase Hearing Sept.12 & 20

Please share this widely!

There’s a Central Hudson rate case that was just opened earlier this summer; the company is requesting an increase in electricity costs for customers in our region. We’d like to invite your organization to get involved!

There’s a few ways you can take a stand against electric & gas bill costs!

Instructions on Registering to Make a Statement

*You must register BY 4:30pm on the day before the hearing. Give yourself extra time to jump through the tech hoops in the registration process! For the hearing, keep your comment to about 1 page long, because there’s a time limit.

STEP 1: Click on the blue links below for the hearing you want to speak at

STEP 2: Enter the password for that specific hearing

STEP 3: Click “Register” (DO NOT CLICK “OK”) underneath

the enter the webinar password box

STEP 4: Click “Register” in the box that appears on the right

STEP 5: Fill out the form & BE SURE TO CHOOSE THE “Yes, I’d like to make a statement” box

Online Hearing One: Tuesday, September 12th at 1pm

Event Number: 2345 253 2876

Password: Sept12-1pm

Phone Access: 518-549-0500

Access Code: 2345 253 2876

Phone-in password: 73781201

Online Hearing Two: Tuesday, September 12th at 5pm

Event Number: 2336 265 2934

Password: Sept12-5pm

Phone Access: 518-549-0500

Access Code: 2336 265 2934

Phone-in password: 73781205

Online Hearing Three: Wednesday, September 20th at 1pm

Event Number: 2338 342 7497

Password: Sept20-1pm

Phone Access: 518-549-0500

Access Code: 2338 342 7497

Phone-in password: 73782001

Online Hearing Four: Wednesday, September 20th at 5pm

Event Number: 2334 829 1678

Password: Sept20-5pm

Phone Access: 518-549-0500

Access Code: 2334 829 1678

Phone-in password: 73782005

Share your story, or the stories of people you advocate for!

Tell decisionmakers whether or not Central Hudson should be rewarded with a rate increase & tell them why you feel the way you do.

Talk about your problems with Central Hudson & whether or not they’ve been remedied.

What effect has being a Central Hudson customer had on your emotional wellbeing or finances, or on the people you help?

Want an official seat at the bargaining table? Become an an “intervenor” in this rate case.

Anyone, and any organization, can sign up to be an official “party” (also known as an “intervenor”) to the upcoming rate case that will determine how much CenHud customers will pay for their electricity. CLP has been a party to Central Hudson rate cases for over a decade; we’ve had some success, and we can share information and resources with you.

What is a rate case?

A rate case is the formal process used to determine what utility companies can charge customers for the delivery of electricity, natural gas, private water and steam service. Interested persons and organizations can “intervene” and become “parties” in a utility company’s rate case.

Who can get involved in a rate case?

Intervenors include: industrial, commercial and other large-scale users of electricity; public interest groups; representatives of residential, low-income and elderly customers; local municipal officials; advocacy groups; and, ratepayers– people just like you!

What’s required (cost-wise, time-wise, etc) to become involved?

The cost is FREE. Folks and organizations who become intervenors will be be working with experienced groups who value and protect your time by letting you know:

- What are the most crucial meetings, and when you should join them to speak up

- How to write the various testimonies/discovery questions

- What specific terms mean

- When we need to make big decisions for the settlement as a whole, and what the various options and their outcomes might be

Please note– rate cases do take time and there are a lot of meetings to go to (currently virtual). Intervenors do not need to attend each meeting, but consistent participation is recommended.

Is there a deadline for becoming a party to the upcoming rate case?

No.

How long does the rate case process take?

The state body overseeing the process is the Public Service Commission (PSC), and they must make a decision within 11 months after a major rate case is filed. Rate cases proceed in an entirely public and open process.

Want to become an intervenor? Aren’t sure if it’s a good fit? Don’t have much time or want to commit, but want to stay involved?

Reach out to us at CLP! We can talk to you about ways you can make a difference, no matter the type of skills or amount of time you have. Email dacruz@

Want to share info about this absurd proposition, so that others are aware and can take action?

Forward this email!

Share our Sept.12th & 20th Online Public Hearing Guide w/registration instructions & evolving talking points/ideas for comments. Here’s a nice-looking link of the guide to share, also: bit.ly/cenhudrateincrease

Share our facebook post (or copy our post language and use it for an eblast or newsletter)!

In Solidarity,

Get Pumped About Getting Off Fossil Fuels Zoom April 30, 2020 from 7 – 8:30 pm

|

|

|

|

|

Solar in the City: Free Solar Workshop Series

Solar power is more affordable and accessible in New York than ever before! Join non-profit Solar One for free online workshops about solar for New York City buildings and residents. Workshop attendees will learn about solar technology, costs, incentives, financing options and more. Workshops will include informative slides, live solar design demonstrations, and Q&A with solar experts and other New Yorkers who installed solar on their building. Register for one or more workshops using the links below, and we hope to see you there!

Solar for New Yorkers

Target audience: all New Yorkers!

Join this introductory workshop for an overview of solar technology, business models, and how to save money with solar at your home or business. Did you know that solar isn’t just for homeowners anymore? Community shared solar allows renters to participate in local solar projects too, saving money and protecting the environment.

Option 1: Thursday, May 7th, 6:00-7:00 PM – Register

Option 2: Friday, May 8, 12:00-1:00 PM – Register

Solar for NYC Co-ops and Condos

Target audience: co-op and condo shareholders/owners, board members, and property

managers

Installing solar on your co-op or condo building can reduce your building’s electricity costs and provide significant tax benefits for the building and residents. Join this workshop for an overview of solar technology, costs, incentives and considerations specifically for NYC co-ops and condos. Learn how your peers are installing solar, what challenges they encountered along the way, and how you can get a free solar feasibility assessment for your building. Workshops will include Q&A with solar experts and board members from co-ops that have already installed solar.

Option 1: Monday, May 11, 6:00-7:15 PM – Register

Option 2: Tuesday, May 12, 12:00-1:15 PM – Register

Solar for HDFC Co-ops

Target audience: HDFC co-op shareholders, board members, and property managers

Join the Urban Homesteading Assistance Board (UHAB) and Solar One for a workshop all about how your HDFC and individual shareholders can save money on your electricity bills. In addition to an in-depth presentation about solar technology, costs, incentives and how more than 25 HDFCs have gone solar through the Co-ops Go Solar campaign, this workshop will provide participants with important information about New York’s temporary moratorium on utility shut offs due to Covid-19, Con Edison’s bill discount program for low- and moderate-income New Yorkers, and opportunities to reduce electric bills in your apartment including efficiency and community solar.

Option 1:Thursday, May 14, 6:00-7:15 PM – Register

Option 2: Tuesday, May 19, 12:00-1:15 PM – Register

Solar for Multifamily Rental Properties

Target audience: landlords, asset managers, and other real estate professionals

Join this workshop to learn how solar can be a powerful tool to reliably increase net operating income for your NYC apartment building(s). In addition to reducing your properties’ common area electricity expenses and/or generating income, solar can reduce your tax bills with generous federal, state and local tax incentives. Join this workshop for an overview of solar technology, costs, incentives, financing options, and optimization strategies to get the most from your rooftops while mitigating risk of forthcoming regulations on building carbon emissions.

Option 1: Thursday, May 21, 9:00-10:00 AM – Register

Option 2: Friday, May 22, 10:00-11:00 AM – Register

Solar for Property Managers

Target audience: NYC property management professionals

Now is a great time for property managers to increase their knowledge about solar energy, and to consider how they can present solar to clients, adding value at a time when everyone is focused on reducing expenses. Join this workshop to learn about solar technology, costs, incentives, the installation process, and O&M. In addition to solar 101, this workshop will cover what property managers need to know to manage a successful solar project from contractor selection through commissioning.

Wednesday, May 27, 9:00-10:30 AM – Register

Retire Don’t Replace Fracked Gas Pipelines!

We have generated 548 comments so far with fact-based evidence that the Public Service Commission can use to deny National Grid their request for a rate hike from our pockets so they can build more climate-crisis-causing infrastructure.

Can we double this number today with Comment Four?

National Grid must Retire Not Replace leaky pipelines, and comply with our climate law to reduce emissions. It make no sense to keep building pipelines that will leak again.

We know that the only option is to replace fossil fuels with energy efficiency and renewables. It’s not only cleaner, but it’s cheaper, and it’s also our law.

We will never stop organizing until everyone is safe, healthy, and can live a life of dignity.

With love,

All of us at Sane Energy!

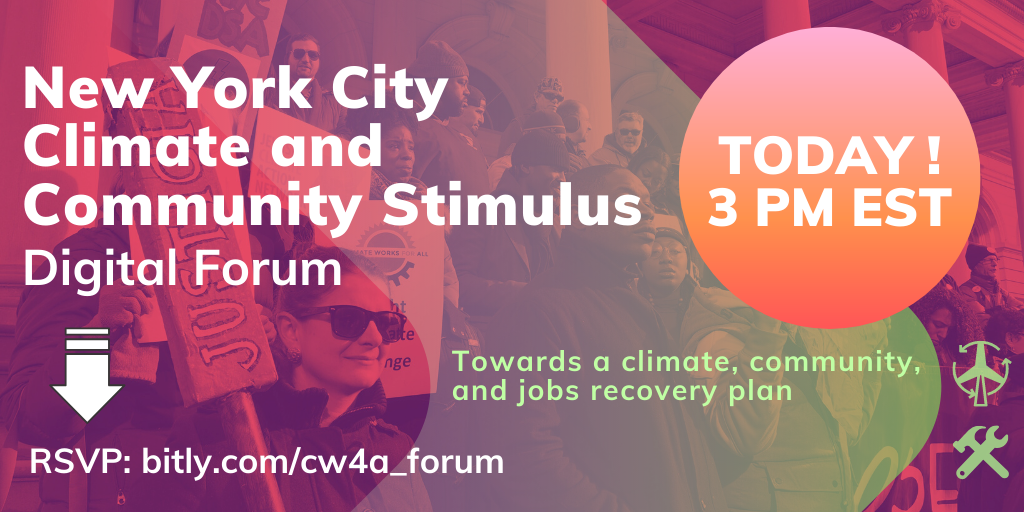

Climate and Community Stimulus Digital Forum

We are in the midst of a global health crisis. The economy is currently collapsing, and we have already seen widespread job loss and trauma for many people that will continue to grow. There is no time to sit and wait. Climate solutions will create direct opportunities for coming out of an economic collapse, but only if there is large-scale, coordinated citywide action rooted in equity. If we get this right today, we can create a forward-looking plan that addresses how our communities, especially frontline communities, can recover from an unprecedented economic crisis and thrive in a post-COVID city by building a just and resilient New York.

In a time of great uncertainty, this much is clear: WE NEED GOOD JOBS. We need to move on a plan to create good jobs as soon as the economy can reopen safely, and that proactive plan can be adopted now. Our movement is coming together – labor unions, community organizations, environmental justice groups, and elected officials – to collectively call for immediate funds from the federal government to help us rebuild as a city. Austerity does not bring prosperity or justice or solutions to climate change. Another world is possible when we come out the other side.

We want to hear your story. If you have lost your job and are currently unemployed and would like to speak at the digital forum about your experience, please email .

In Solidarity,

Maritza Silva-Farrell

Executive Director

ALIGN NY

The State of EVs in the HV

|

|

Advocate for climate justice at Senator Pete Harckham’s Peekskill office Friday, FEB 28 2 PM

Time is running out to win climate, jobs, and justice in this year’s New York State budget.

We need to act now.

Sign up to visit Senator Pete Harckham’s Peekskill office on February 28th at 2 p.m. to request climate, jobs, and justice in this year’s budget! We will meet at 1:30 p.m. at Dunkin’ Donuts, Crossroads Shopping Center, 1101-09 Main Street, Peekskill, NY, 10566. Parking instructions will be emailed to you after you sign up.

February 28th is the last time our legislators and/or their critical legislative teams will be in their district offices before they submit their budgets for final negotiations. We need to make sure they hear from us about how critical it is to include climate justice funding in this year’s budget.

FOR EXAMPLE — We’re asking for at least $1 billion now, and at least $7 billion per year by passing the Climate and Community Investment Act. What’s this?

The Climate and Community Investment Act will make polluters pay for the toxic pollutants and greenhouse gases they emit into our air. It would raise $7-$10 billion per year that would be invested directly into our communities. This money would fund:

-

Green jobs and infrastructure: Building utility-scale wind turbines and solar panels, making our buildings more efficient, updating our electric grid, expanding public transit upstate, and more

-

Community Just Transition Fund: Direct grants to community orgs to support community-led energy planning, reduce local emissions, and increase resiliency. 75% of funds go to marginalized communities.

-

NY Energy Rebate Fund: Direct assistance to low and moderate income families to reduce the burden of energy costs. Families are automatically opted in.

Impacted Worker Fund: Cash and job training to impacted workers, funds to replace lost tax revenue for municipalities and school districts, expanding economic development programs.

Join us to tell Senator Harckham on February 28th: we can’t wait — fund climate justice now!

We will make sure you’re prepared and trained with materials, talking points, signs, and leave behinds. Meet at 1: 30 p.m. at Dunkin’ Donuts, Crossroads Shopping Center, 1101-09 Main Street, Peekskill, NY, 10566, parking instructions will be mailed to after you sign up.

Senator Pete Harckham stood with us last spring when the Climate Leadership and Community Protection Act was passed. Let’s make sure he does it again, and funds climate justice in this year’s budget and beyond.

In solidarity,

Lobby Lead for NY Renews

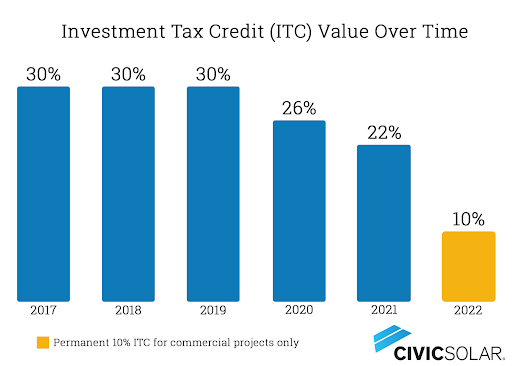

ACT NOW to Extend the ITC

Yesterday an important update regarding the fight to extend the Investment Tax Credit (ITC) was sent out from the President & CEO of SEIA, Abigail Ross Hopper. SEIA has been spearheading advocacy for the extension of the ITC for months and has reached a critical juncture in the effort.

A strong call to action has been set by the SEIA team noting that, “…intel from Capitol Hill indicates that lawmakers are on the cusp of a deal on tax legislation as we speak, and it is time to pull out all of the stops and make our voices heard in Congress.”

The ask is simple: urge your representatives to speak with House Leadership and ensure an ITC extension is included in legislation before the end of the year.

To aid in this effort, SEIA has prepared scripted materials and an online form to find legislatures near you. This won’t take more than 5 minutes of your time and the info submitted will not be added to any email list. In case you missed it, here is a link to SEIA’s recent email explaining this update.

Now is the time to mobilize your team and get on the phones to call your local Representative.

Extending the 30% ITC in 2019

Please note, this material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Whether you’re a trained and savvy solar professional or only started looking into solar yesterday, this article will provide you with everything you need to know as we approach the first year of the tax incentive decline. The remainder of 2019 will be the last chance for those involved in the solar industry to exploit the full 30% credit before it steps down from 30% to 26%. In order to best advise today’s customers and clients, contractors and distributors alike will need to familiarize themselves with the rules and regulations surrounding the “Commence Construction” Clause.

Beginning with the Energy Policy Act in 2005, solar professionals throughout the US have been attentively keeping an eye out for any and all information regarding the first major government regulated incentive towards renewable energy technologies- the Investment Tax Credit (ITC). This enactment of the ITC was the first time that solar energy project owners were offered access to a 30% tax credit on a cost basis of their qualified energy property in the year that it was first put into service.

In 2015, on the eve of the expiration of the original 30% ITC, Congress approved the Consolidated Appropriations Act of 2015 (P.L. 114-113). This included an extension of the 30% ITC for both commercial and residential projects through Dec 31, 2019, with a step down to 26% in 2020, and 22% in 2021. In 2022 the remaining 10% tax credit would remain intact for commercial projects only. In addition to extending the ITC tax credit, this Act also amended the requirement for qualifying a project from having to be “in-service” to instead needing to have “commenced construction”. According to the IRS Notice 2018-59, the two steps necessary to indicate that you’re eligible for this year’s tax credit under the “commence construction” clause are as follows:

-

PHYSICAL WORK TEST: SECTION 4.02-.04: “The Physical Work Test requires that a taxpayer begin physical work of a significant nature. This test focuses on the nature of the work performed, not the amount or the cost.” This work performed can include the installation of racks or other various structures to attach PV panels, collectors, or solar cells to the site (4.02.2.A). This does not include any preliminary activities such as planning or designing an array design, obtaining permits or licenses, securing financing, the clearing of a site, or conducting geophysical/environmental/engineering surveys of the site (4.03). It is important to note that physical work also does not include the effort involved in producing “the components of the energy property that are either in existing inventory or are normally held in inventory by a vendor.”

-

Continuous Construction Test (Section 6): “Involves continuing physical work of a significant nature. Whether a taxpayer maintains a continuous program of construction to satisfy the Continuity Requirement will be determined by the relevant facts and circumstances.”

-

-

FIVE PERCENT SAFE HARBOR: SECTION 5. 01-.02: “Construction of energy property will be considered as having begun if: (1) a taxpayer pays or incurs 5% percent or more of the total cost of the energy property, and (2) the taxpayer makes continuous efforts to advance towards completion of the energy property” (5.01). Meaning that the estimated total of all costs of the energy venture in question are taken into account when trying to evaluate whether or not the Five Percent Safe Harbor standard has been established. This total does not include the price of the land intended to house the energy property.

-

Continuous Efforts Test (Section 6): “Whether a taxpayer makes continuous efforts to advance towards completion of an energy property to satisfy the Continuity Requirement includes, but is not limited to: (a) paying additional amounts included in the total cost of the energy property; (b) entering into binding written contracts for the manufacture, construction, or production of components of property or for future work to construct the energy property; (c) obtaining necessary permits; and (d) performing physical work of a significant nature.”

-

“Do I have to complete both of these steps before January 1, 2020 in order to satisfy the requirements necessary to receive the 2019 tax credit?”

– In section 3.02 of the IRS Notice 2018-59, it is explained that while yes solar project taxpayers must implement both of these actions in order to qualify the “commence construction” clause, the construction will be considered to be underway starting on the date the taxpayer first establishes the first of these two methods. “For example, if a taxpayer performs physical work of a significant nature on [the] energy property in 2018, and then pays five percent or more of the total cost of the energy property in 2019, construction will be deemed to begin in 2018 under the Physical Work Test, not in 2019 under the Five Percent Safe Harbor” (Section 3.02).

“I heard I have 4 years to complete my energy project and still apply for the ITC credit level of the year in which I first “Commenced Construction”, is that true?”

-

According to an article released by McDermott the answer is technically yes, but let me explain. This notice clarifies that after a commercial project has been approved for the ITC (aka the taxpayers have been able to purchase equipment equal to 5% of anticipated project costs and passed the Physical Work Test) in 2019 it will permit projects placed in service up until January 1st, 2023 to qualify for the ITC at the current 30% rate from 2019. Although it is important to note that construction and significant payments of the energy property must continue throughout this 4 year time period to remain in good graces for the Continuity Safe Harbor.

-

“If a taxpayer places an energy property in service by the end of a calendar year that is no more than four calendar years after the calendar year during which construction of the energy property began (“the Continuity Safe Harbor Deadline”), the energy property will be considered to satisfy the Continuity Safe Harbor. For example, if construction begins on an energy property on January 15, 2018, and the energy property is placed in service by December 31, 2022, the energy property will be considered to satisfy the Continuity Safe Harbor (Section 6.05).”

Based on the information gathered from the IRS Report 2018-59 to claim the 30% ITC this year all you have to do is: Make a 5% payment on the total cost of the system in conjunction with a written contract to guarantee the continuous development of the solar array, or begin physical work of a significant nature in regards to the installation process (ie. “racking or other structures to affix PV panels, collectors, or solar cells to a site”) before January 1st, 2020.

Claim your tax credit now!

Find all the information you need from Solar Power Rocks

Sources:

https://www.greentechmedia.com/

https://www.greentechmedia.com/

Image: